Newsletter

Inside this month, confusion over personal income tax changes and what you are really entitled to, why the Government does not want your business accepting cash payments of $10,000 or more, the tax treatment of compensation from financial institutions, and FBT and Uber style ride sharing services.

Confusion over personal income tax changes – what are you really entitled to?

The recent income tax cuts that passed through Parliament do not mean everyone automatically gets $1,080 back from the Government as soon as they lodge their income tax return. The Australian Taxation Office (ATO) has been inundated with calls from taxpayers wanting to know where their money is and how they can access the $1,080 they now believe is owing to them.

What changed?

From 1 July 2018

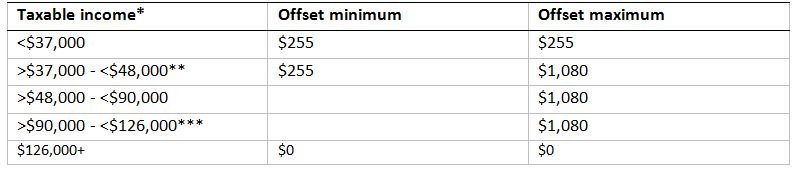

A low and middle income tax offset (LMITO), first introduced in the 2018-19 Federal Budget, provides a tax benefit to those with taxable incomes below $125,333. Recent changes increase the LMITO from a maximum of $530 to $1,080 and the base amount from $200 to $255, and make it applicable to a greater number of taxpayers by increasing the threshold from $125,333 to $126,000.

The first thing to remember is that this is a tax offset; you need to owe tax to offset the tax. And, if you owe tax, the offset will be first used to reduce the tax you owe. It is not a cash back – a point the ATO is at pains to point out stating on its website that, “It doesn’t mean that you will get an extra $1,080 in your tax return.”

The offset applies for a limited time. In this case, the offset applies to the 2018-19, 2019-20, 2020-21 and 2021-22 income years. So, if you are eligible to receive the offset, it applies to the taxable income you earned last financial year (2018-19) and you will receive any offset owing once you have lodged your tax return.

If you earned taxable income in 2018-19 of:

- Less than $21,885, while you have an entitlement to LMITO of $255, you do not pay personal income tax and therefore cannot utilise the offset.

- $45,000, you will receive a tax reduction of $855 ($255 plus 7.5% on every dollar between $37,000 and $45,000, in this case $8,000). You may also be eligible for the low income tax offset (LITO), see below.

- $85,000, you will receive a tax reduction of $1,080.

The LMITO is in addition to the existing low income tax offset (LITO). The LITO is available to those with taxable income of less than $66,667. The maximum offset is $445 for those with taxable incomes of $37,000 or less. Any amount you earn above $37,000 up to the threshold of $66,667 reduces the offset by 1.5%. Once again, the LITO is a tax offset to reduce the amount of tax you pay. If you do not pay personal income tax, you do not receive the offset as a cash refund.

From 1 July 2022

Two things occur from 1 July 2022:

- Income tax rate thresholds change – the top threshold of the 19% personal income tax bracket increases to $45,000 (currently $37,000), effectively providing a tax cut to all taxpayers earning over $18,200. The tax rate change applies to resident taxpayers and working holiday makers.

- The low-income tax offset (LITO) increases – for those with taxable income of less than $66,667, the LITO base amount will increase from $445 to $700. However, the LITO will reduce quicker than it currently applies with amounts above $37,500 reducing by 5% for amounts up to $45,000, then 1.5% to $66,667.

These changes assume that the Government does not pare back the income tax changes in a future Budget.

From 1 July 2024

From 1 July 2024, the 32.5% marginal tax rate will reduce to 30% and the number of taxpayers it applies to will increase with the maximum threshold moving from $120,000 to $200,000. The tax rate change applies to resident taxpayers and working holiday makers. Once again, this assumes that this tax rate and threshold change is not amended in a future Federal Budget.

‘Proof of life’ certificates required for overseas pensioners

One of the stranger pieces of legislation to be introduced into Parliament last month is an attempt to ensure that overseas welfare recipients over the age of 80 are in fact, alive.

There are approximately 96,000 people permanently living overseas who currently receive an Australian social security payment. The majority of these receive the age pension. At present, the system relies on a relative to advise Services Australia that the recipient of the payment has passed away for payments to cease. Government data suggests that, “there is a disparity in the death rate of pensioners aged 80 years and above overseas, compared to pensioners in Australia.” So, either living overseas is good for your health and people are living longer than Australian norms suggest, or deaths are simply not being reported. The Government is betting on the latter.

Amendments introduced into Parliament would require welfare recipients aged 80 years and over, who have been absent from Australia for at least two years, and receiving certain social security payments, to give a ‘proof of life’ certificate at least once every two years when the Department requests one. Proof of life certificates are a common practice in many European countries. If the proof of life certificate is not forthcoming within 13 weeks of being requested, payments will be stopped 26 weeks after the date of notice. If there is an error and the certificate is provided late, payments will resume and arrears paid.

Proof of life certificates will need to be verified by an authorised third party, such as a judge or magistrate, a medical doctor, or authorised consular staff at an Australian embassy, consulate or high commission.

The amendments apply to the Age Pension, Carer Payment, Disability Support Pension, Widow B Pension, or Wife Pension, where the recipients have been continuously absent from Australia throughout the previous 2 years.

Why the Government does not want your business accepting cash payments of $10,000 or more

From 1 January 2020, the Government intends to restrict the value of cash payments a business makes or accepts to amounts under $10,000. Ignoring the limit will become a criminal offence with penalties of up to 2 years in prison and/ or $25,200*.

Payments of $10,000 or more will need to be made electronically or by cheque.

Well, easy enough you say, just break it up into smaller amounts! But, the law has already thought of that. The cash payment limit will apply to the total price of a single supply of goods or services, regardless of whether the price is split into a series of payments over time. If a customer is making cash payments over time, for example instalment payments on a car, the total cash component cannot equal or exceed $10,000 – payments above this amount will need to be made using alternative payment methods.

If a genuine mistake has been made, you will need to be able to prove that you, “reasonably believed that a payment did not include an amount of cash that was equal to or exceeded the cash payment limit.” Making a mistake does not stop the breach being an offence, it merely limits the fault element. Recklessness is not a genuine mistake.

Why the change?

The cash limit initiative came out of the Black Economy Taskforce and targets untraceable payments. The concern with large cash payments is that cash can be anonymous and untraceable. Making payments in cash makes it easier for businesses to underreport income, and to offer consumers discounts for transactions that reflect avoided obligations, gaining a competitive advantage over businesses that either cannot or will not offer such discounts. In other words, under the counter deals.

Interaction with AUSTRAC reporting entities

Dovetailing into the new cash payments limits are changes to AUSTRAC reporting. At present, financial services, trading in bullion, and gambling services generally need to report to AUSTRAC for transfers of physical or digital currency of $10,000 or more.

From 1 January 2021, certain AUSTRAC reporting entities will not be required to report physical cash transactions of $10,000 or more as they will be unable to make or accept them.

The cash payments reform was originally announced in the 2018-19 Federal Budget and were due to commence from 1 July 2019 but pushed back to 1 January 2020. The reforms are not yet law and are currently before Parliament.

*120 penalty units for individuals. Entities face 300 penalty units per offence (currently $63,000).

FBT and Uber style ride sharing

When an employee uses a taxi service for travel to or from work or if the employee is sick, it is generally exempt from Fringe Benefits Tax (FBT) under the FBT taxi travel exemption. The question is, what about Uber and other ride sharing services, do they also qualify for the exemption? If Uber is considered to be a taxi for GST purposes, that is, all drivers need to be registered for GST and charge GST as they are considered to be a taxi service, does the FBT exemption extend to employees using Uber for travel?

The ATO has confirmed its view that travel in ride sharing services is not exempt from FBT under this specific exemption as they do not meet the definition of a taxi service under the FBT laws (even though they do under GST law).

However, this does not mean that FBT will necessarily apply to travel undertaken by employees using a ride sharing service.

FBT taxi travel exemption

Taxi travel by an employee is an exempt fringe benefit if the travel is in a single trip that begins or ends at the employee’s place of work. In addition, if the taxi travel is a result of sickness or injury to an employee and some or all of the journey is directly between the employee’s place of work, their residence or any other place that is necessary or appropriate for the employee to go as a result of the sickness or injury, it would qualify as exempt.

Under FBT law, a taxi is “… a motor vehicle that is licensed to operate as a taxi.”

Ride sharing and FBT

While an Uber trip is ‘taxi travel’ for GST purposes, and therefore GST applies as there is a $0 GST threshold, the ATO’s view is that it would not generally meet the definition of a taxi for FBT purposes as ride sharing drivers re not generally “licensed” to operate as a taxi.

If an employee travels to or from work in an Uber that is not a licensed taxi and the cost is covered by their employer then the FBT taxi travel exemption does not apply and the trip would trigger an FBT liability for the employer unless:

- The “otherwise deductible rule” applies (i.e., the employee would have been able to claim a deduction for the trip); or

- The minor benefits exemption applies (i.e., the value of the benefit is less than $300 and is provided on an infrequent and irregular basis).

Tax treatment of compensation from financial institutions

By 30 June 2019, five major financial institutions paid $119.7 million in compensation for poor financial advice to 6,318 customers. The question is, how are these payments treated for tax purposes?

The tax treatment varies according to why the compensation was paid and who the payment was made to. Compensation payments are made for a number of reasons including fee for no service, deficient advice, or overcharging for insurance premiums for death or disability insurance cover. Each one has different tax consequences.

In some cases, the compensation will be assessable income and in others will impact the cost base of any underlying investment. If an investment has already been sold, the compensation may trigger a capital gains tax liability and in some cases it will be necessary to amend prior year tax returns.

There may also be GST consequences. In general, the GST treatment will mirror the GST consequences for the financial institution that made the payment. If you or your superannuation fund claimed GST credits, these may need to be repaid where a compensation amount includes a GST component.

Managing the tax treatment of compensation payments can be tricky. If you or your superannuation fund has received a compensation payment, please let us know as soon as possible so we can assist you get the tax treatment right.

Weirdest tax deductions revealed

Would you claim the Lego you bought for your kids throughout the year as a tax deduction? One taxpayer did and it made the Australian Taxation Office’s 2018-19 list of most unusual claims.

The Lego was not the only claim for money spent on kids. Another taxpayer claimed their children’s sports equipment and sporting membership fees. Others claimed school uniforms, and before and after school care. And, others claimed, “the cost of raising twins,” the “cost of raising three children” and simply, “New born baby expensive.” Yes indeed, but the expenses, while often shocking to parents, are not deductible.

Cars were also a favourite. The ATO says that “many” taxpayers tried to claim the full purchase price of their new cars as a tax deduction. This included the taxpayer who claimed the cost of the new car he bought for his mother as a gift. Nice gesture but still not deductible.

Medical and dental expenses also featured heavily. The most striking was the couple that claimed the cost of their dental expenses, “believing a nice smile was essential to finding a job.” Medical and dental expenses in general are personal expenses and not deductible.

Also making the list was the couple who claimed the cost of their wedding reception as a tax deduction.

The unusual claims all came from the ‘Other’ deductions section of the tax return. In order to claim an ‘other’ deduction, the expenses must be directly related to earning income and you need to have a receipt or record of the expense. If your expense relates to your employment, it should be claimed at the work-related expenses section of the return.

Quote of the month

“If everyone is thinking alike, then somebody isn’t thinking.”

– General George S. Patton

This article is for use of a general nature only and is not intended to be relied upon as, nor be substitute for, specific professional advice. No responsibility for loss occasioned to any persons or organisations acting on or refraining from action as a result of any information or material on our website will be accepted. Please ensure you contact us to discuss your particular circumstances and how the information provided applies to your situation